[Bitop Review] Tech Stocks Sell-Off, Bitcoin Dips Below 73K as Capital Rotates to Value Stocks

2026年02月04日发布

Influenced by multiple factors including geopolitical tensions and the partial government shutdown causing delays in economic data releases, market risk aversion has risen, leading to a simultaneous decline in tech giants and Bitcoin. US stocks are showing clear sector rotation, with funds flowing from high-valuation growth stocks to cyclical value stocks, making the tech sector the worst performer in the S&P 500. Bitcoin briefly fell below 73K, marking a new low since November 2024. Year-to-date, Bitcoin has declined by 16%, reflecting investors' continued withdrawal from risk assets amidst an unstable macro environment.

US Sector Rotation: Tech Slumps While Value Rises

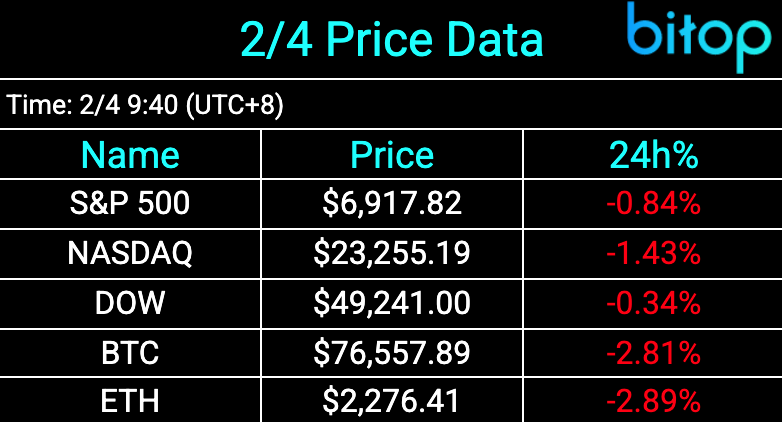

Yesterday, the three major US indices were mixed, indicating a significant shift in capital. The S&P 500 fell 0.84%, while the tech-heavy Nasdaq dropped 1.43%. Despite the broader market closing lower, the majority of S&P 500 components actually rose, showing that capital is moving away from the previously leading "Magnificent Seven" toward cyclical sectors. Retail giant Walmart saw its market cap break the $1 trillion mark, and FedEx continued its rally. Meanwhile, Nvidia and Microsoft both dropped more than 2%, with the software sector being the hardest hit, reflecting growing investor skepticism regarding the ratio of high AI capital expenditures to actual returns.

Bitcoin Breaks 73K: Hitting a 16-Month Low

The cryptocurrency market faced strong selling pressure yesterday. Bitcoin briefly dipped below 73K, touching $72,945, a new low since November 2024. Since the beginning of the year, Bitcoin has fallen by a cumulative 16%, reflecting the trend of investors exiting risk assets due to macro instability.

Glassnode Account Manager Sean Rose pointed out that 44% of the Bitcoin supply is currently held at a loss, as the token has fallen approximately 30% from its recent high of 108K over the past month. This has reduced the "supply in profit" from 78% to 56%, suggesting that weak hands may continue to sell.

Rose stated:

"Top buyers near the ATH are now holding at a loss. Concentrated supply with cost basis near recent highs is being tested. These investors' conviction and patience will be tested in the coming weeks and month."

Bitcoin's Relative Strength Index (RSI) is currently hovering near the oversold level of 30. The last time the RSI was this low was near the bottom of the 2022 bear market, after which the Bitcoin price subsequently fell by another 20%. If a similar trend occurs today, it implies that the Bitcoin price could drop to around $60,000.

Future Outlook: Heavyweight Earnings and AI Investment Sustainability

The focus for the remainder of the week will be on the earnings performance of tech giants. Alphabet (Google's parent company) and Amazon will release earnings on Wednesday and Thursday, respectively. The market will strictly examine whether these companies' spending on AI infrastructure is bringing corresponding revenue growth. Additionally, whether the software sector can stabilize from the current collective correction, and whether Bitcoin will trigger further cascading liquidations, are risk points investors need to watch closely. Analysts warn that after a three-year bull run, market valuations are relatively high, and any negative factors could trigger further sell-offs.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.