[Bitop Review] Bitcoin Rebounds to $78K, Risk of "Super Crypto Winter" Looms if $70K Support Breaks

2026年02月03日发布

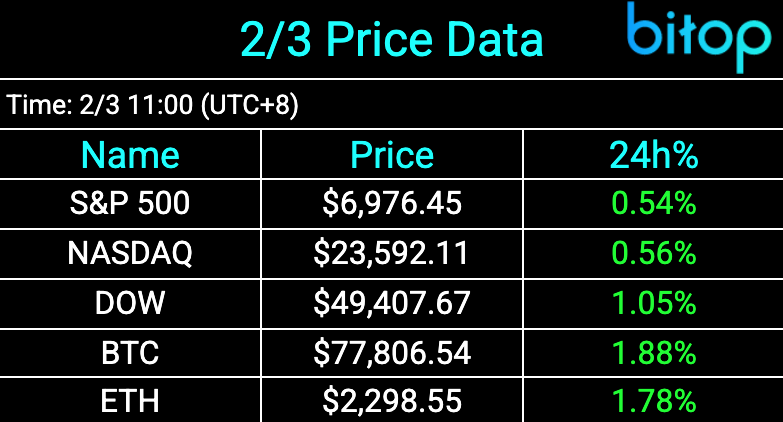

After a frantic weekend sell-off, the market staged a rebound on Monday (Feb 2). Bitcoin dipped to an intraday low of $74,604 yesterday morning—a level not seen since last April. While it has recovered above $78,000 as of press time, it remains 7% below last Friday's pre-crash level of $84,000. Bitcoin's recent weakness—characterized by following downward trends while lagging in rallies—has severely dampened investor sentiment. Consequently, analysts are downgrading support levels, with some predicting a bottom as low as $40,000. This would represent a 70% plunge from all-time highs, signaling a potential "super crypto winter."

US Manufacturing Recovers, Market Halts Decline

U.S. President Trump stated that he would lower tariffs on India to 18% after Prime Minister Modi agreed to stop purchasing Russian oil, easing tensions between the two nations.

The Institute for Supply Management (ISM) Manufacturing Index released on Monday rose from 47.9 to 52.6. A reading above 50 indicates expansion. Bolstered by strong U.S. factory data, this provides optimistic signals for the economy and corporate profits. Sustained growth will help strengthen confidence that the manufacturing sector is recovering after a three-year slump.

Due to the partial government shutdown, the U.S. Bureau of Labor Statistics will not release the January employment report on Friday as scheduled. This week, the market awaits earnings reports from tech heavyweights such as Amazon, Alphabet, and AMD.

Bitcoin Recovers from $74K to $78K: Decline Slows, but Long-Term Confidence Hit

Despite recovering from a low of $74,604 to over $78,000 on Monday following the weekend's intense sell-off, the crypto market remains down 7% compared to last Friday's highs. Market observers note that Bitcoin is displaying a weak characteristic of "following drops but not rises," diverging from its usual correlation with traditional safe-haven or risk assets.

Market analyst Hasegawa suggests that Bitcoin's "short-term bottom" may be around $70,000, serving as a "key reference point." However, he added that if the market continues to decline sharply, a significant adjustment in market conditions may be necessary.

Meanwhile, Benjamin Cowen, founder of Into The Cryptoverse, and on-chain researcher Checkmate, using different charts and models, have both concluded that Bitcoin's support lies within the critical $60,000 to $70,000 range.

History Repeating? Analysts Warn of "Crypto Winter"

However, some analysts believe Bitcoin prices could fall much further. In a CNBC interview, John Blank, Chief Equity Strategist at Zacks, stated that Bitcoin could drop to $40,000 this year.

Blank derived this figure by observing highs and lows from previous cycles.

During past crypto winters, Bitcoin prices have plummeted 70% to 80% from their all-time highs. Bitcoin reached a record high of $126,000 last October. A drop to $40,000 would represent an approximate 70% decline from that peak.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.