[Bitop Review] MicroStrategy Spends $27.2 Million to Add 220 Bitcoins, Total Holdings Exceed 640,000 BTC; MSTR Has Underperformed BTC Year-to-Date

2025年10月14日发布

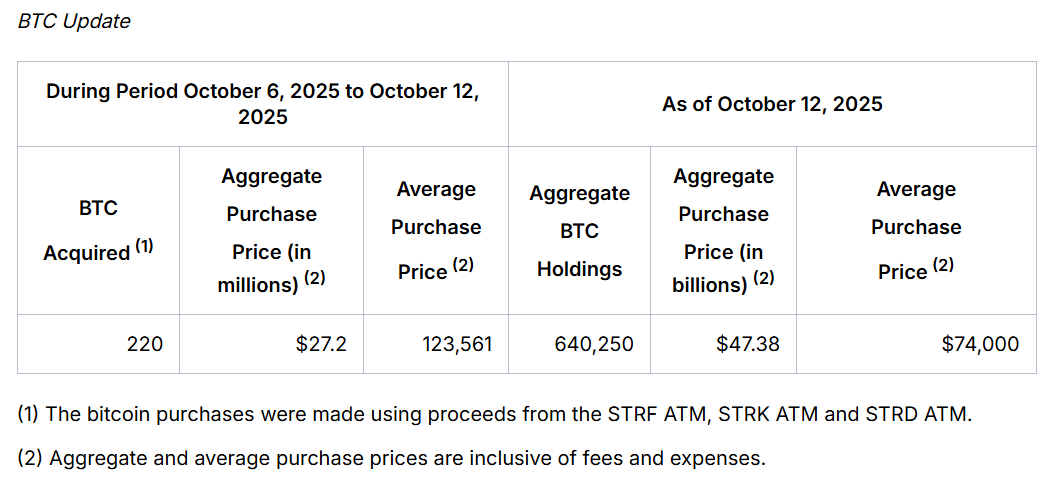

Leading Bitcoin reserve company MicroStrategy announced on October 13 that it spent $27.2 million to purchase an additional 220 Bitcoins between October 6 and October 12, at an average price of $123,561 per Bitcoin.Following this addition, MicroStrategy's Bitcoin holdings have officially reached 640,250 BTC, with a total investment of $47.38 billion and an average cost of $74,000 per Bitcoin.

MicroStrategy's ATM Program Remains Well-Funded

According to MicroStrategy's announcement, its ATM program (At-the-Market Offering) still has approximately $46.25 billion available for fundraising, including:

STRF ATM: $1.699 billion

STRC ATM: $4.2 billion

STRK ATM: $20.367 billion

STRD ATM: $4.145 billion

MSTR ATM: $15.908 billion

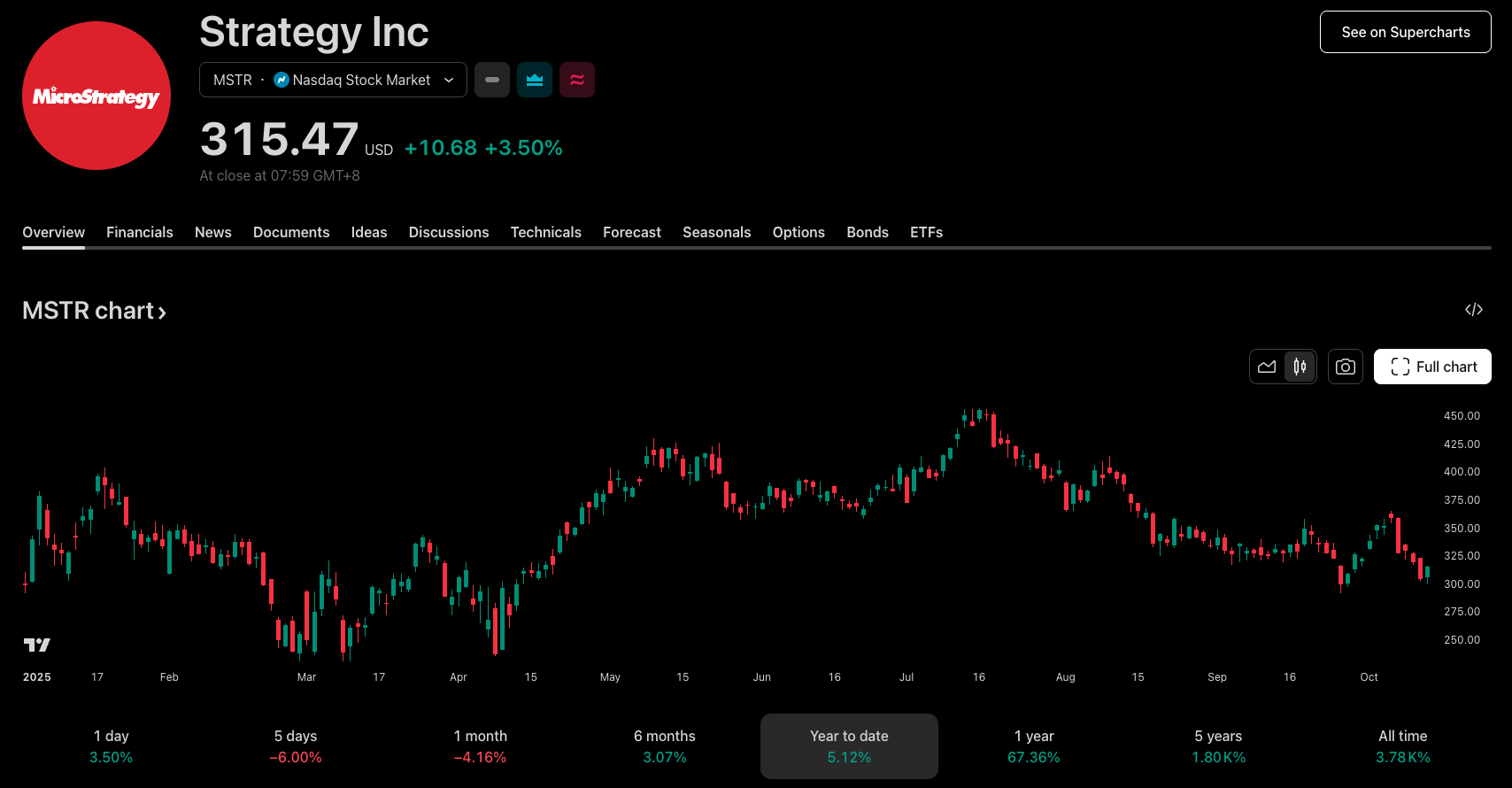

MSTR Stock Performance

MicroStrategy's stock MSTR has experienced significant volatility over the past month. In early October, MSTR briefly surged to $360, but likely influenced by the large-scale liquidations in the crypto market on October 11 and the subsequent drop in Bitcoin's price, MSTR's current share price has fallen to around $300, with its market cap slipping to $87.5 billion.Extending the timeline to the beginning of the year, MSTR's stock has only risen by 5% year-to-date, far lagging behind Bitcoin's 23% increase.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.